Reading Time: 8 minutes

How to Start a Business with research, budgets and regulations.

There are many important steps to think about when starting a business, and they are the same throughout the world. Starting a business is a big decision, but you really need to get right, straight off the bat (right from the start). You need to take many key steps to start your business successfully, and I have shared them with you below.

Research your business idea – is it viable?

You need to make sure there is a market for your business idea, which is why market research is important. The market research you do will tell you if there is a market with customers (customer research) and competitors (competitor analysis) and a need for your business idea.

Customer research gives you a better understanding of your customer to help you understand how customers purchase, what products and services they want, and how to make these products and services better than your competitors.

By conducting customer research, you can understand your customer’s age, location, and interests as an example. This allows you to create your ideal customer profile/persona/avatar.

You can conduct your customer research by using the internet, talking with groups, asking questions with surveys and one-on-one interviews, and so much more.

Competitor analysis helps you understand what is currently out there, how well it works and what you can do better.

You can use many of the same research methods to research your customers to identify your competitors. Once you have identified your competitors, you can compare them to each other, review what part of your market they are in, their strengths and weaknesses, and what threat they pose to you (use a SWOT analysis for this).

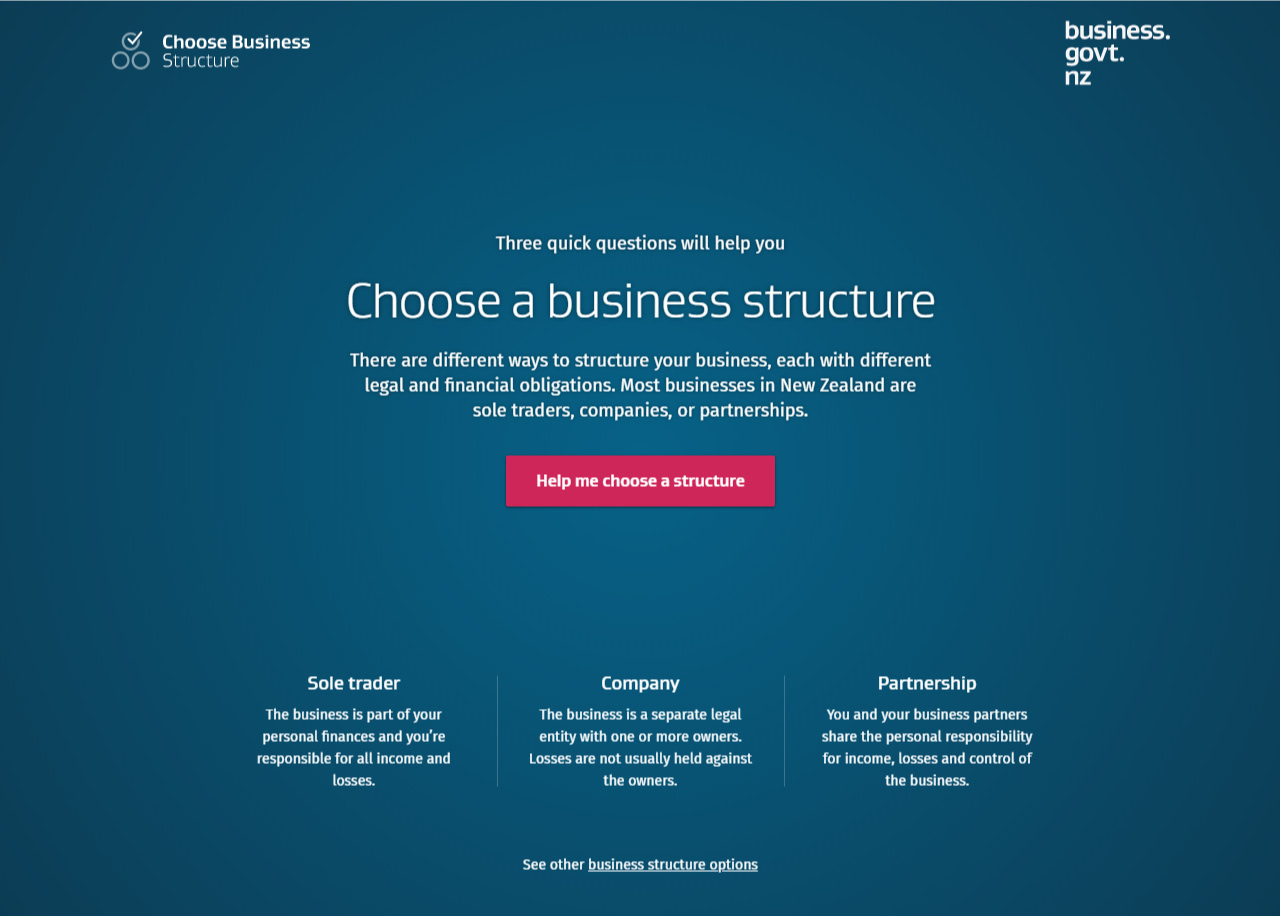

Business Structure

It would help if you thought about how we structure the business before we actually register it. It is best to do it now to place all this relevant information into our next steps, the financial forecasts and business plan creation.

The New Zealand government tries to make it as easy as possible for people to start a business. They have provided a useful webpage that asks three questions to help you identify what business structure is correct for your business.

Below are the different types of business structures.

Sole Traders

Registering as a sole trader is ideal for people who start contracting independently. Many small businesses are contractors and self-employed people, so choosing to begin as a sole trader is the most cost-effective and simples option to get started.

- It’s super easy to set up and get going.

- Low Start-up costs.

- You are solely responsible for all debts.

- It is harder to get loans or finance.

You can choose to register your business as a company at any time.

You can find my article on business structures for a more detailed explanation of the different types here.

Partnerships

Registering as a partnership is ideal for two or more people to form a business. Partners create the business with an agreement, and this agreement sets out how they’ll share profits, debts and work. This type of business structure is common among architects, lawyers and accountants.

- Each partner can run a section of the business.

- All costs of the business are shared.

- Partners can bring in more capital investment.

- Partners can offset losses against other income.

- Each partner is liable for all the partnership’s debts — putting personal assets at risk.

- You may be responsible for paying off your partners’ business debts too.

You can find my article on business structures for a more detailed explanation of the different types here.

Company

A company structure is very different to the sole trader and partnership structures listed above. A company is totally separate from the people who own it; the company directors and shareholders.

The company shareholders are responsible for paying the company’s debts up to the value of the shares they own. They’re also entitled to a dividend, which is a share of the company’s profits.

- Shareholders’ liability is limited to the amount they paid for their shares.

- Tax rates are lower than top personal rates.

- It’s easier to sell the business, and it has more value

- The business can grow easier

- There’s more regulation than for sole traders and partnerships.

- Companies can need more investment to grow.

- Directors have legal responsibilities.

A company is far more complicated than the other business structures as there are many legal requirements that a company needs to abide by.

You can find my article on business structures for a more detailed explanation of the different types here.

Business Names

Choosing what to call your business is the initial step in building your brand. You should have now completed the research on your business idea and found your business idea is sound, and there is a market. You might as well chose a name for your business if you haven’t already thought of its name before now. I know personally that I seem to think of business ideas and names before I even do the market research, which is not technically the right way of doing things. Still, I find the idea and naming process a bit more enjoyable.

Unless you lend your own name to your business, choosing one can take time, energy and patience. Whatever your business does, its name should:

- your name needs to be easily remembered

- your name needs to be one of a kind

- your name needs to be easily spoken

- your name needs to say what you do.

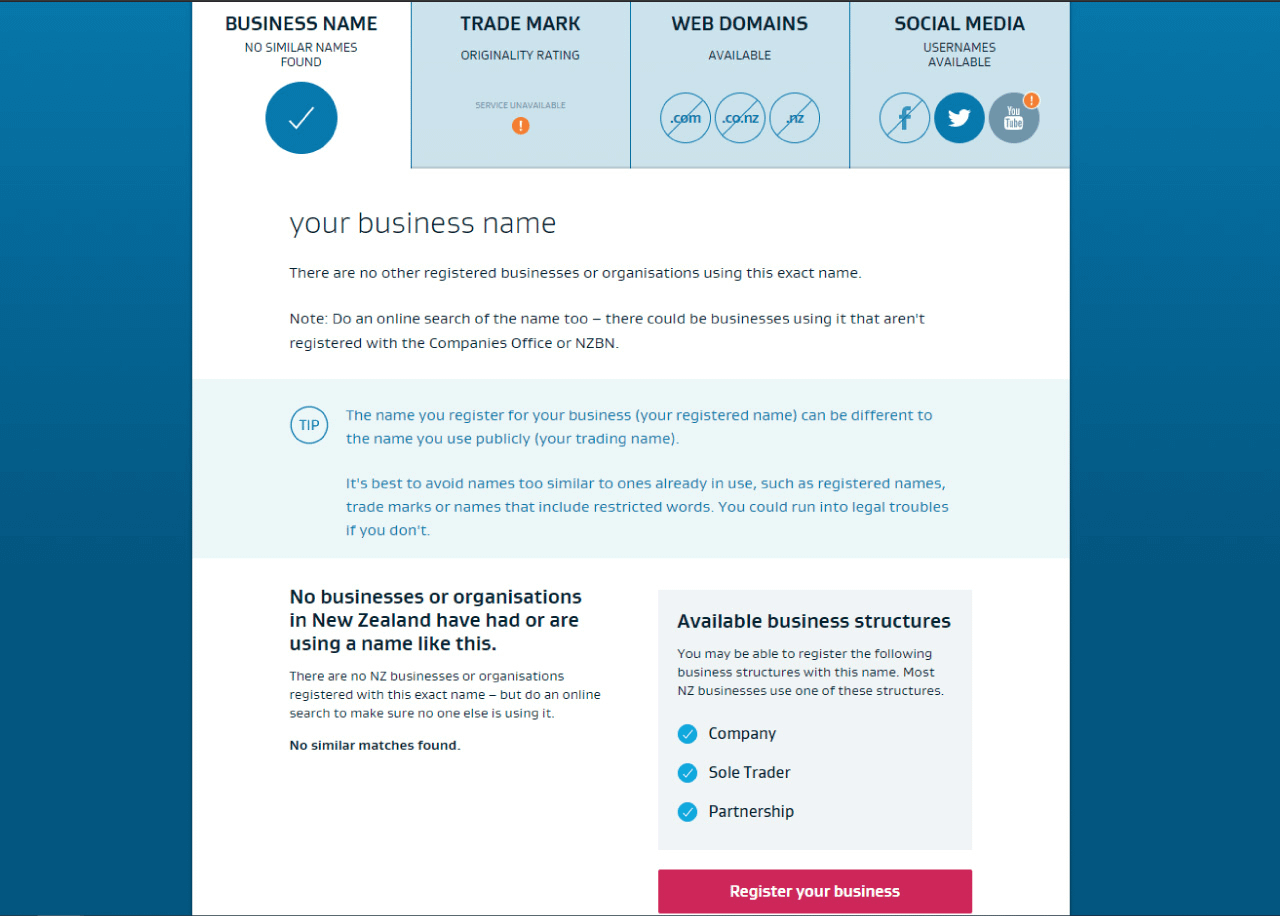

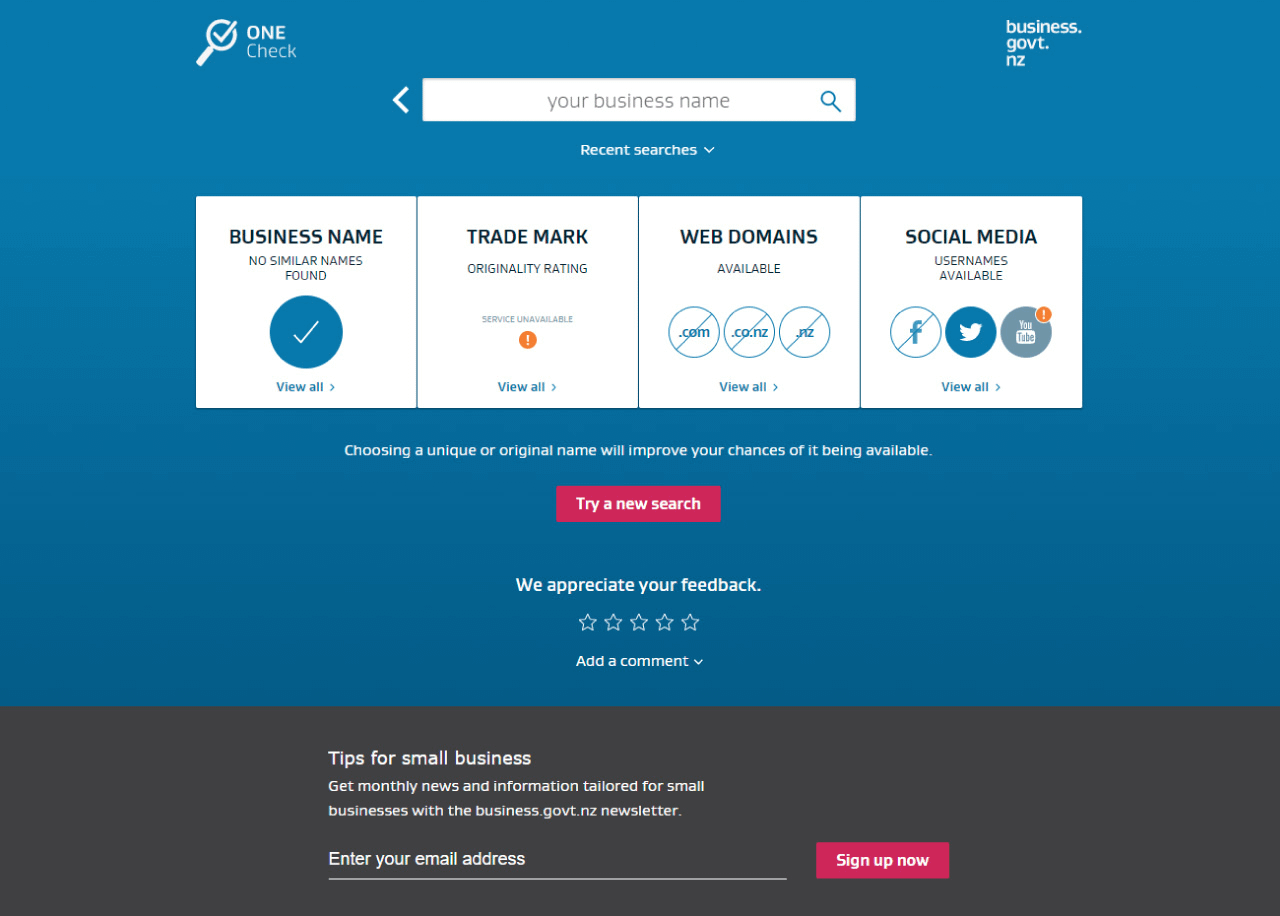

Secure Your Business Name

At this stage, you should go to the governments business site ONECheck and check if your business name is available. The website will then show you if your chosen business name is available, if there is any trademark, if the web domains are available and if the social media accounts are free. If your chosen business name is indeed available, you should register the name. You need to click on the view all link, and you can then click the register your business button.

You can choose through the Companies Office (for registering a company) or an NZBN number (if you are registering as a sole trader or a partnership).

Please Note: No matter what business type you register under, it is required to register for GST if you’re earning more than NZ$60,000 each year. If you are registering as a company, you will be required to register for GST. If you register as a sole trader or partnership and start to earn $60,000, you can register online at ird.govt.nz.

Once you have registered a business, you will need to communicate with the government, so you might as well get your RealMe login sorted.

Domain Names

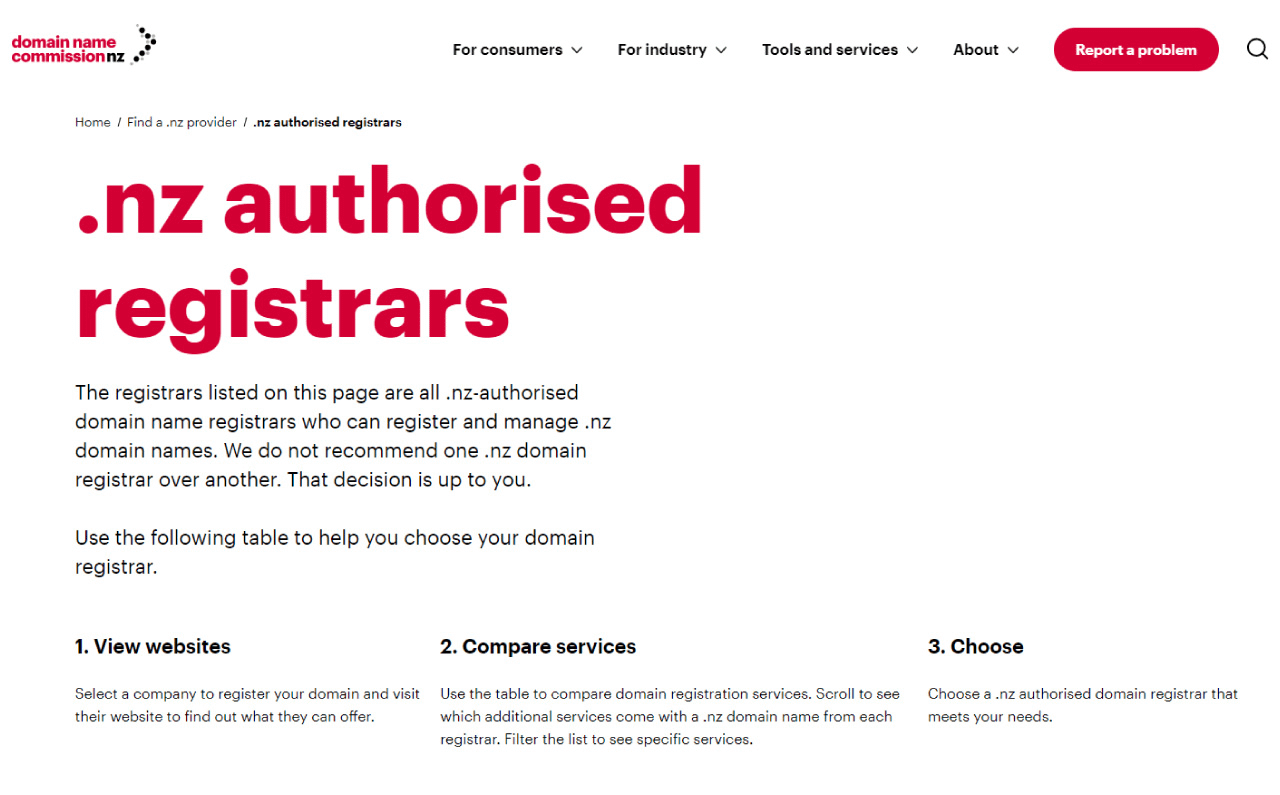

Now you have chosen our business name and registered your company, sole trader or partnership; it is best to secure the domain name associated with it. The ONECheck website would have told you if the domain and what extensions were available. When you click view all, you can then click the button for registering your domain. This then takes you to the .nz registrars webpage, where you can scroll and choose an authorised registrar to register your domain name.

I personally believe it is good practice to register the .co.nz along with the .nz domains, and if you want to have a more worldwide domain, then I suggest, if possible, you register the .com domain name as well. Before registering the .com domain, make sure you do a trademark check in the USA for your business name, as this will save you a lot of stress down the track if there is a trademark!

Business Plan

Planning is one of the most important things you can do for your business. A business plan is your road map for your business; it provides you with the steps to execute, describes what you do product and service wise, identities your customers and explains how you will market your products and services and most importantly, how you will make money.

There are different types of business plans, the one-page and the comprehensive business plan. Some believe that a comprehensive business plan is not required and prefer to utilise a one-page business plan. No matter what you choose, it will help you be more successful and create good practices from the get-go.

How to write a one-page business plan

No matter what style of business plan you create, there are some key areas that you need to speak to, and these are below.

- The Value Proposition

- The market problem and how you solve it

- Your target market and competition

- What funding you will need and how you will use it

- How you are going to sell and marketing to your customers

- Sales budgets and goals

- Milestones, what dates, values etc

- Who the team and any partner opportunities

Xero has a fantastic one-page business plan template here.

How to write a comprehensive business plan

This business plan style covers the same key points as the one-page plan, but you can go into more detail, allowing for a more in-depth and detailed plan.

All of your market research needs to be put into your business plan, and you can go into as much detail as possible. This is a great time to speak with an accountant or bookkeeper, as well as a business advisor (you can check out my business advisory services here) to help you flesh it all out. Financial budgets need to be created for many years and need to cover as much as you can think of.

The key points you need to cover in great detail are listed below.

- Executive summary

- Company overview

- Products or services

- Market analysis

- Risk assessment

- Marketing and sales plans

- Milestones

- Progress reporting

- The team

- Budgets & forecasts

- Financials

Xero has also created a very in-depth business plan template which you can download for free.

Another good version of a comprehensive business plan is the New Zealand government, which is also free to download.

You can also find the governments Quick Fire business plan here, which is great to understand in more detail about what to do.

Just remember, a business plan shouldn’t be a static document; it should be ever-evolving, the same way your business does. In fact, once you complete your business plan, it probably is already out of date and in need of an update.

Budgets & Forecasts

Budgets help you understand how much money the business could generate and how much it will cost you to run. Without doing budgets and forecasting, you don’t know if you can afford to start the business and what your return would possibly be.

A budget will help you easily understand the following.

- How much will your business idea cost to get off the ground?

- How much do you need to run it weekly, monthly and yearly?

- The cost of the team

- Do you need to borrow money?

- How much you will need to charge your products and services out to make a profit.

The best way to do a budget is by listing all the known costs and when they will occur. It is important to know the times of costs occurring to forecast your money situation (cash flow). This needs to be completed in the same way for your income projections.

It is always best to look at forecasting in a positive and negative light. In other words, create a budget that looks like you think you will go and another that is less appealing with slower growth. It won’t always go the way you planned, so it is best to know the scenarios so you can plan for both.

If it takes time for you to get sales, you need to have a contingency plan for funding the business until it can afford to pay for itself. It would help if you thought of how you will do this. Will it be personal funds, business loans or investors?

For obvious reasons, you want to know if the two are seriously out of whack. So check your budget against actual business numbers regularly. That way, you can fix problems before they get too big and spot opportunities before they’re missed. Plus, the exercise will help you get better at estimating costs and income for the years ahead. Small business budgeting and forecasting go hand in hand.

Summary

This article clearly outlines the steps needed to start a business correctly but is not an all-encompassing article that goes into great detail in every step. This article is designed to get you researching and reviewing other businesses as part of your preparation. Doing your research, obtaining your business name through the governments business websites and making sure you register your domain names is made easy thanks to how simple our government has made the process. Hence, there is no excuse for not taking the time to register and obtain all you need to.

Take your time, do it right, and enjoy the process by doing it correctly at the start, and remember, as long as you are focused and taking action towards starting a business, you are in a good spot.

Please take a look at other useful articles on my website here.

You can find my business advisory services here.